By James Eugene

We all know the story by now. Both emerging and frontier markets have taken quite a battering over the past few months and have contributed to an $11 trillion hemorrhaging of fund from global markets, as well as a collapse in Asian currencies, in the third quarter of 2015. But buried beneath the doom-and-gloom headlines is how one market, Lativa’s Riga Stock Exchange (or OMX Nasdaq Riga), managed to defy a trend that so many of us have become accustomed to.

The MSCI Emerging Market Index has declined by around 20% this year, with the MSCI Frontier Market Index only doing a few percentage points better. The OMX Nasdaq Riga, however, has enjoyed a 25% year-to-date boost, ranking it as one of the best (if not the best) performing frontier markets so far this year. Only 5 out of 93 markets have posted gains since June, with the negative returns attributed to the crisis faced in China.

The Main Cause? One Stock.

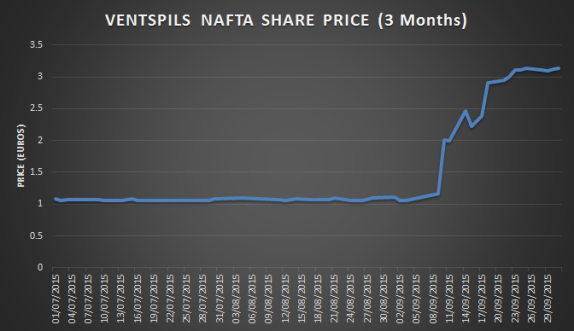

On a global scale, Latvian stocks were able to boast the largest gains in the third quarter of this year. This was due to the fact that Vitol Group, the largest independent energy trader in the world, announced its plan to increase its stake in Latvia’s pipeline operator Ventspils Nafta Tranzits by 43.25% (an $80 million purchase), which equates to 93% percent of the total company. After the news was announced, Ventspils’ shares initially increased by 73%, before tripling in value over a 15 day period.

Ventspils has a significant weighting in the 25-member index, comprising of 36%. This large weighting consequently allowed the change in share price to filter through to the market, increasing its value by around 30%. The value of the market has not fluctuated much for a relatively long period of time due to infrequent trading.

Robert Kirkup, Chairman of Ventspils, has stated that Vitol has plans to purchase the rest of the Latvian pipeline company before eventually desisting the company.

According to Moody’s, “Latvia’s implementation of structural reforms is helping to alleviate macroeconomic imbalances between domestic and external demand. Together with increased flexibility in the export sector, this supports growth in excess of the euro area average”. The ratings agency also expects the Baltic nation to cut its deficit down to 1.5% of GDP between 2015-2016, which is a major improvement compared to the deficit the country faced in 2009, which stood at around 9% of GDP.

Discussion

Trackbacks/Pingbacks

Pingback: 2015’s Top 5 Frontier Markets | EMerging Equity - January 3, 2016

Pingback: Frontier Markets in 2015 | Kenyan Wallstreet - January 5, 2016

Pingback: 7 Emerging And Frontier Markets Beating The Global Downturn | EMerging Equity - February 17, 2016